Find Out More

Find Out More

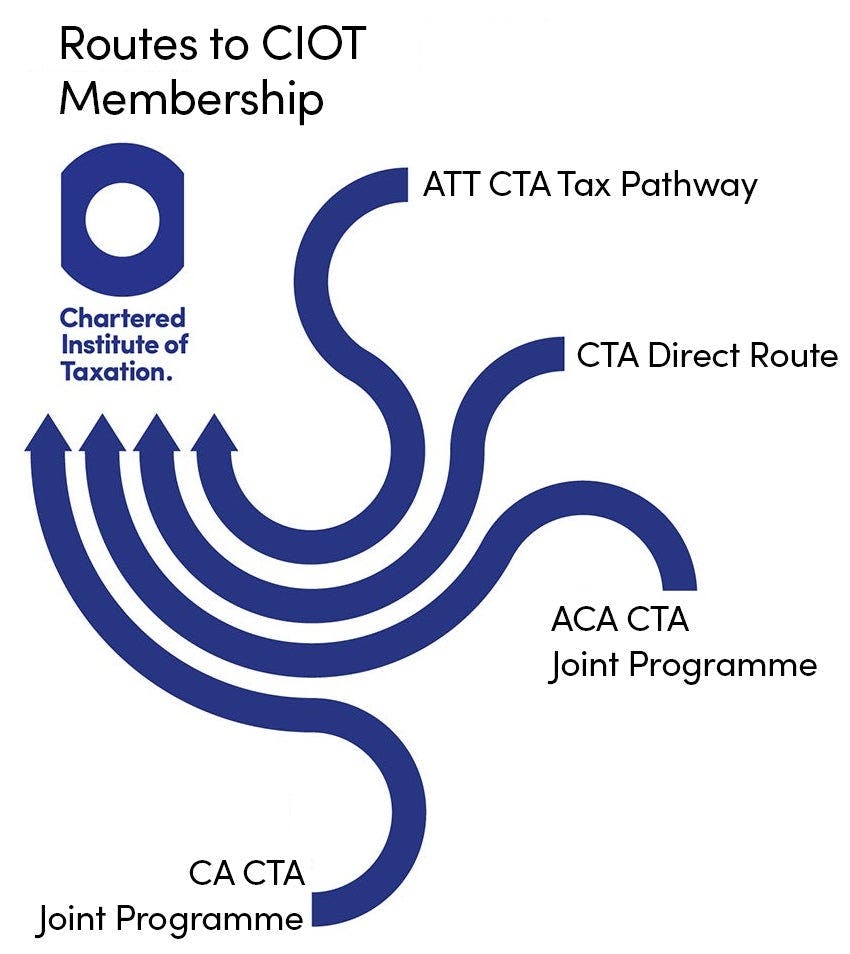

Which CTA Route Is Right For You?

The CTA Direct Route

You may choose the stand-alone option, which involves taking the CTA qualification. This comprises of seven exams: four tax exams and three Computer Based Exams (CBEs).

View more information on the CTA Direct Route.

ATT CTA Tax Pathway

How it works

The Tax Pathway enables you to gain the ATT and CTA in a more streamlined way.

Benefits

- More variety - You can choose any of the six ATT exams at Core Knowledge 1 and 2. At the Core Knowledge 2 stage, you can choose to sit the CTA Awareness exam instead of an ATT exam

- Up-to-date content - The exam syllabus is updated annually to account for changes in the field of taxation

- No previous qualifications required - You don’t need any particular qualifications or experience to take the Tax Pathway

- Excellent support and resources available

View more information about the Tax Pathway.

Those residing in India are not permitted to register to take any ATT qualifications, this includes the ATT-CTA Tax Pathway. If any applications are submitted, they will not be accepted, and any fee paid will be refunded within 28 days.

ACA CTA Joint Programme

The ACA CTA Joint Programme is a combination of the ICAEW’s ACA and the CIOT’s CTA qualifications.

How it works

You can join this programme on the first day of your ACA training agreement or Level 7 apprenticeship, or partway through a training agreement. The only other prerequisite is that you must work in tax.

Benefits

- Achieve a qualification in less time - The ACA CTA requires significantly less study time compared to taking the ACA and CTA qualifications separately. You can become dual qualified in as little as three to four years

- Reduced cost - The cost of the qualification is reduced because there are fewer examinations to take

- Less overlap in the syllabus - This programme has been designed to minimise any overlap between the ACA and CTA syllabi

- Specialise in tax and accounting - You will become a dual qualified specialist in tax and accountancy once you complete this qualification

View more information about the ACA CTA Joint Programme.

CA CTA Joint Programme

How it works

The CA CTA Programme is a combination of the CA of the Institute of Chartered Accountants of Scotland (CA) and the CTA of the Chartered Institute of Taxation (CIOT). It’s ideal for anyone wishing to accelerate their professional development in tax and accountancy.

Benefits

- Reduced time - Compared to taking the CA and CTA qualifications separately, this programme requires significantly less study time. You can become dual qualified in as little as three to four years

- Reduced cost - With fewer examination to take, the cost of these qualifications is reduced

- Less syllabus overlap - Some of the content in the CA and CTA is similar, so this programme has been designed to minimise any overlaps

- Become a specialist in tax and accounting - Once you achieve the CA and CTA qualifications, you can become a dual qualified specialist in tax and accountancy

View more information about the CA CTA Joint Programme.

Level 7 Apprenticeship

How it works

This employer-designed standard is another route to becoming a Chartered Tax Adviser. This Apprenticeship typically takes 36 months to complete, depending on prior qualifications and work experience.

Benefits

- Equivalent academically to a Masters qualification - While not technically a master's degree, the Level 7 Apprenticeship is the same academic level

- Develop your knowledge, skills and behaviours - The Level 7 Apprenticeship assess key skills and behaviours such as business insight, professional scepticism, building relationships, and continuous improvement

- Earn a prestigious qualification while you work - This qualification enables you to integrate professional work experience with rigorous academic study

View more information about the Level 7 Apprenticeship route

Still not sure which qualification is right for you?

Please don’t hesitate to contact us.